Penny Stock Investment Guide: Effective Screening Criteria for New Investors

To start investing in penny stocks – stocks with very low prices, often under $5 per share – you'll need a powerful stock filter to identify attractive opportunities. However, if you don't have a stock screening tool yet, don't worry! I can help you set up simple but highly effective criteria. With just a few basic parameters, you'll be able to find promising penny stocks while avoiding unnecessary risks. Let’s begin with some simple steps to conquer this market!

Stock Price:

Under $5: This is the price range that penny stocks typically fall within. Stocks priced between $1 and $5 will be in this range. However, you can also consider stocks under $1 if you are willing to accept higher risks.

Trading Volume:

Daily Trading Volume: Penny stocks often have low trading volumes, but you should look for stocks with a daily volume of at least 500,000 shares. This ensures that the stock has good liquidity, making it easier to buy and sell without significantly affecting the stock price.

Price Volatility:

Beta: The Beta coefficient measures the stock’s volatility relative to the broader market. For penny stocks, you may want to look for stocks with a Beta greater than 2.0, as these have high price fluctuations and the potential for higher returns (but also higher risks).

Daily Price Change: A penny stock might experience daily price fluctuations of 5% to 10% or even more, depending on the market and news.

Market Capitalization:

Micro-cap: Penny stocks typically have small market caps, under $300 million.

Small-cap: Some penny stocks may have market caps ranging from $300 million to $2 billion. These stocks also have growth potential but still come with risks.

Small-cap stocks are a common choice for penny stocks, but if you prefer less risky stocks, you might consider small-cap stocks.

Basic Financial Ratios:

P/E Ratio (Price-to-Earnings Ratio): The P/E ratio can be challenging to evaluate for penny stocks since many companies in this category have unstable earnings or no profits at all. However, if available, a P/E ratio between -5 and 20 could be considered reasonable.

P/B Ratio (Price-to-Book Ratio): Penny stocks may have a high P/B ratio (greater than 2.0) if the company has significant assets but little profit. You should look for stocks with a P/B ratio ranging from 1.0 to 3.0, depending on your investment strategy.

Debt-to-Equity Ratio: Penny stocks can have fairly high levels of debt. A debt-to-equity ratio between 0.5 and 2.0 is reasonable for stocks in this category, but be cautious with companies that have excessively high debt ratios.

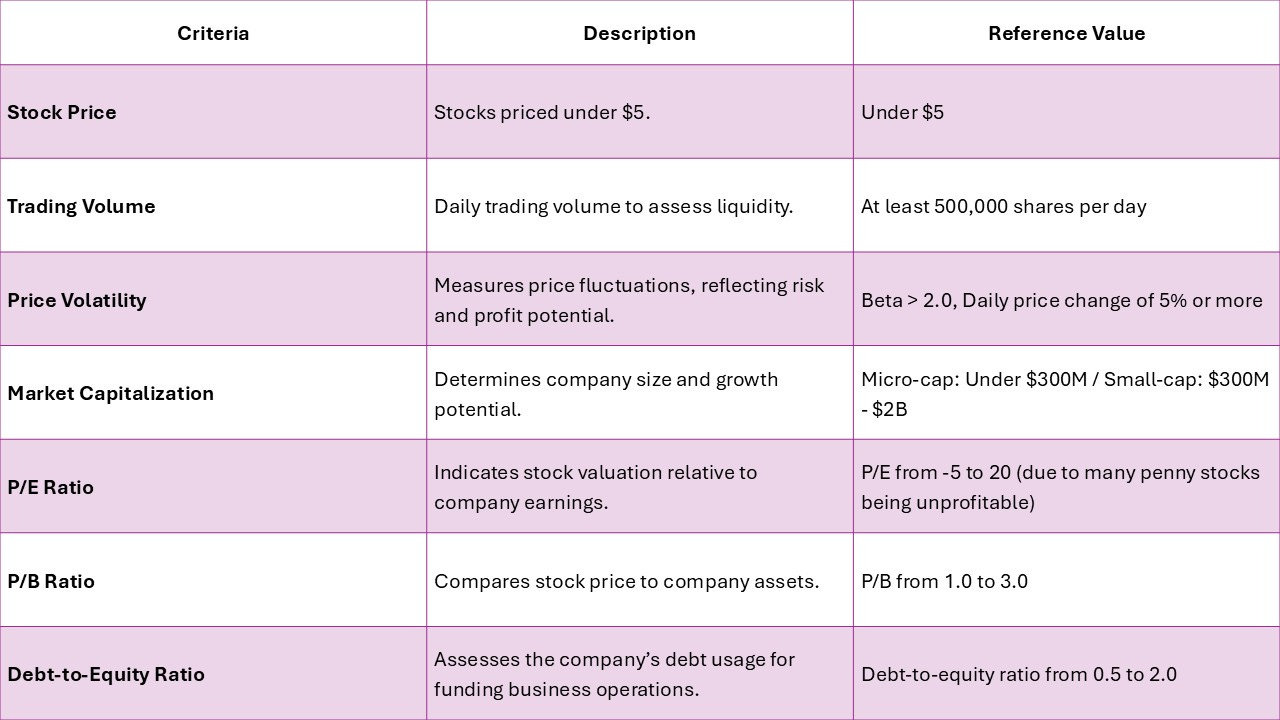

Summary of Screening Criteria: Here is a table of the criteria to filter penny stocks, making it easy to visualize and apply when looking for investment opportunities.

The table above provides an overview of the key criteria for screening penny stocks.